BLOG

Unraveling Kennedy Funding Ripoff Report Mysteries

In the realm of financial lending, few names stir more curiosity and skepticism than Kennedy Funding. The term “Kennedy Funding ripoff report” is often searched by those eager to uncover truths, myths, and everything between about this notable lender. Whether you’re an investor, borrower, or simply a curious individual, understanding the intricacies of Kennedy Funding and the reports surrounding it could be crucial. This blog post aims to demystify these aspects, providing you with a comprehensive guide to navigating the world of Kennedy Funding.

The Background of Kennedy Funding

Kennedy Funding is renowned for offering hard money loans, a type of financing used in real estate transactions. Hard money loans are typically short-term and offered by private lenders at higher interest rates. This contrasts with traditional bank loans that involve lengthier approval processes. Kennedy Funding prides itself on speed and flexibility, often coming to the rescue when time is of the essence.

Established in the late 1980s, the company has survived numerous economic cycles, showcasing resilience and adaptability. Its foundation rests on meeting urgent financial needs with a focus on real estate investments. Today, Kennedy Funding is one of the more prominent players in the hard money lending sector.

Despite its reputable standing, the term “ripoff” has surfaced in various reviews and reports. This raises questions about what exactly these concerns entail. Is it a matter of misunderstanding the nature of hard money loans, or are there genuine grievances that potential borrowers should be aware of? Understanding this duality is key to making informed decisions.

What Are Ripoff Reports?

Ripoff reports are consumer complaint websites where individuals can post grievances about companies. These platforms help consumers share experiences, either as warnings or advice for others contemplating similar transactions. While useful, the reliability of such reports often depends on the credibility of the person posting them.

For Kennedy Funding, these reports seem to center around dissatisfaction with terms, conditions, and customer service. The nature of hard money loans may lend itself to misunderstandings, given their distinct departure from conventional lending practices. Still, it’s essential to dissect these reports to determine their validity.

In evaluating ripoff reports, one must consider both the specificity and frequency of complaints. Are there consistent themes, or do the complaints vary widely? Understanding the pattern, if any, can inform potential borrowers about what to anticipate and which aspects require caution.

Common Themes in Kennedy Funding Complaints

When examining Kennedy Funding ripoff reports, several common themes emerge. These include dissatisfaction with upfront fees, perceived high-interest rates, and misunderstandings about loan terms. It’s crucial to analyze these areas to ascertain their significance.

1. Upfront Fees: Some borrowers have expressed concerns regarding fees paid before receiving funds. While not uncommon in hard money lending, understanding fee structures beforehand can help manage expectations and prevent surprises.

2. Interest Rates: Due to the high-risk nature of hard money loans, interest rates are typically higher. Complaints often stem from borrowers feeling unprepared for these rates or believing they were initially misled about them.

3. Loan Terms: The flexibility of hard money loans means terms can vary significantly. Misunderstandings may arise if borrowers do not fully comprehend their agreements, leading to frustration and unexpected obligations.

By exploring these themes, potential borrowers can better equip themselves to ask pertinent questions and seek clarifications before committing. Thorough research and open discussions with loan officers are vital in ensuring transparency and satisfaction.

The Importance of Due Diligence

Before engaging with any lender, especially in the realm of hard money loans, due diligence is paramount. This involves thorough research into a lender’s history, reputation, and practices. For Kennedy Funding, this means scrutinizing reviews, understanding the nature of their lending, and being clear on all terms and conditions.

Potential borrowers should start by reading reviews from various sources, not just ripoff reports. Cross-referencing information can provide a more balanced view of the lender’s standing. Besides, speaking with current or past clients can yield personal insights that written reviews may not capture.

Additionally, understanding one’s own financial standing and needs can aid in determining whether a hard money loan is suitable. Consideration of alternatives and consultation with financial advisors can offer broader perspectives, ensuring that borrowers are not rushing into decisions that may not align with their best interests.

Navigating the Application Process

When dealing with Kennedy Funding or any hard money lender, the application process is typically more straightforward than traditional loans but requires thorough preparation. Being prepared with necessary documentation and a clear understanding of the desired loan type is essential.

Prospective borrowers should prepare financial statements, appraisals of collateral, and clarity on the purpose of the loan. The more detailed and organized the application, the smoother the process will likely be. Potential borrowers should also be ready to negotiate terms and ask questions about anything unclear.

During the application process, maintaining open communication with loan officers can facilitate understanding and trust. This transparency can help mitigate potential misunderstandings that often lead to dissatisfaction and negative reports.

Engaging with Customer Support

One crucial factor in evaluating any financial service is the quality of customer support. For Kennedy Funding, engaging actively with their support team can yield better satisfaction. Borrowers should not shy away from reaching out with queries, concerns, or requests for clarification.

Positive engagement with customer support can assist in resolving issues before they escalate into complaints. It is beneficial to document all interactions and confirmations to reference future misunderstandings or disputes.

Good customer service is often an indicator of a company’s overall commitment to client satisfaction. By evaluating this aspect, borrowers can gain insights into how likely they are to experience smooth transactions and fair treatment.

Red Flags in Lending Practices

While many ripoff reports may derive from misunderstandings, certain red flags in lending practices should not be ignored. High-pressure sales tactics, reluctance to provide written agreements, and unclear fee structures are potential warning signs.

Borrowers should exercise caution if they encounter any pressure to sign quickly or if the lender is unwilling to provide detailed, written explanations of terms. Transparency is critical, and a reputable lender should readily furnish comprehensive documentation.

By remaining vigilant for these red flags, borrowers can protect themselves from potential pitfalls and ensure they engage in secure and fair financial transactions.

The Role of Regulation

Hard money lenders operate under specific regulations, although they differ from those governing traditional banks. Understanding these regulations can assist borrowers in safeguarding their interests and holding lenders accountable.

Each state may have varying regulatory requirements for hard money lenders. Familiarizing oneself with these can empower borrowers to understand what constitutes fair practice and identifies any deviations from standard procedures.

Borrowers should feel empowered to report any unethical practices to appropriate authorities. Knowing one’s rights and the regulatory landscape adds an extra layer of protection in navigating the complexities of hard money lending.

Learning from Others’ Experiences

One effective way to gauge a company’s reliability is by learning from the experiences of others. Reading testimonials, both positive and negative, can provide a broader understanding of what to expect.

Analyzing patterns in feedback can reveal strengths and weaknesses, offering insights into whether Kennedy Funding aligns with your financial needs and expectations. Engaging with community forums and discussions can further illuminate personal experiences beyond formal reviews.

Community knowledge serves as a valuable resource in making informed decisions. Leveraging collective wisdom can lead to better outcomes and improved confidence in navigating the financial landscape.

Ensuring Financial Alignment

A successful borrowing experience hinges on ensuring that financial goals align with the loan’s terms. Borrowers must assess whether the loan supports their objectives without compromising financial stability.

It’s prudent to conduct a thorough cost-benefit analysis, weighing the loan’s advantages against potential risks. Borrowers should maintain realistic expectations about repayment capacity and long-term financial implications.

By ensuring financial alignment, borrowers can minimize the risk of financial strain or regret. Careful planning and realistic projections contribute to a successful borrowing experience.

Building a Positive Borrower-Lender Relationship

A positive relationship with a lender fosters mutual respect and understanding. Engaging in proactive communication and fostering trust can lead to a more satisfying borrowing experience.

Prospective borrowers should approach the lending process as a partnership, where both parties work towards a shared goal. Transparency, honesty, and mutual respect form the foundation of a successful borrower-lender relationship.

Building rapport with loan officers and maintaining courteous interactions can enhance the overall experience and facilitate smoother transactions.

Conclusion

Kennedy Funding presents an intriguing option within the hard money lending sphere, offering distinct advantages and challenges. By thoroughly understanding the nature of ripoff reports and engaging in due diligence, potential borrowers can make informed decisions that align with their financial goals.

Navigating the world of hard money loans requires vigilance, transparency, and proactive engagement. Armed with the insights and guidance offered in this blog post, readers can confidently explore and evaluate their options, ensuring a secure and rewarding borrowing experience.

BLOG

MuchoHentai: A Critical Examination of an Evolving Adult Anime Niche in the Digital Age

This article provides a critical examination of MuchoHentai, situating it within the larger ecosystem of adult anime consumption. It explores its origins, audience appeal, controversies, and impact on internet culture, while also analyzing the ethical, legal, and cultural frameworks that continue to shape the niche.

Understanding MuchoHentai in Digital Culture

MuchoHentai, literally meaning “perverse” or “abnormal” in Japanese, has evolved far beyond its literal translation. In Western contexts, it refers specifically to anime and manga with explicit adult themes. Over the past three decades, it has transformed from a subcultural curiosity to a mainstream digital phenomenon, accessible globally through streaming sites, fan communities, and specialized platforms like MuchoHentai.

Its popularity stems from several factors:

-

Artistic stylization – exaggerated characters, fantasy worlds, and imaginative scenarios.

-

Niche diversity – a wide spectrum of subgenres catering to highly specific tastes.

-

Digital accessibility – the internet has democratized access, allowing communities to flourish worldwide.

MuchoHentai positions itself as one of the hubs where these cultural, technological, and fan-driven currents converge.

The Role of MuchoHentai in the Online Ecosystem

MuchoHentai has become more than just a content archive. It functions as a gateway into the adult anime niche, offering accessibility, categorization, and community. Its growing recognition reflects how adult digital platforms are increasingly shaped by three key factors:

-

Curation and Accessibility

-

MuchoHentai centralizes content that would otherwise remain fragmented across smaller sites.

-

Its streamlined interface appeals to both casual viewers and dedicated fans seeking specific niches.

-

-

Community-Building

-

Like many fandom-driven spaces, MuchoHentai benefits from user interaction, discussions, and shared recommendations.

-

This fosters a sense of belonging for enthusiasts who may feel marginalized in mainstream online spaces.

-

-

Cultural Amplification

-

By spotlighting hentai media, MuchoHentai contributes to the global normalization of adult anime within internet culture.

-

Audience Appeal: Why MuchoHentai Attracts Viewers

The success of MuchoHentai highlights the unique appeal of hentai itself, which differs from traditional adult entertainment.

-

Fantasy without limits – Animation allows creators to bypass real-world constraints and imagine scenarios impossible in live-action media.

-

Aesthetic variety – From minimalist line art to highly detailed animation, hentai appeals to fans of Japanese art and anime styles.

-

Exploration of taboo – For many users, hentai provides a safe, fictionalized space to explore desires that might be socially stigmatized.

-

Community validation – Platforms like MuchoHentai reduce stigma by offering shared spaces where preferences can be discussed openly.

This convergence of art, fantasy, and community explains why the platform continues to thrive despite its niche status.

Ethical and Legal Considerations

No examination of MuchoHentai would be complete without addressing the ethical and legal complexities surrounding hentai.

-

Legality

-

While hentai is legal in many countries, certain subgenres raise concerns about obscenity laws or the depiction of characters resembling minors.

-

Platforms like MuchoHentai must navigate varying international regulations, which can impact hosting, accessibility, and content moderation.

-

-

Ethical Boundaries

-

Critics argue that hentai can blur lines between fantasy and harmful representation.

-

Defenders emphasize that hentai is fictional, existing within artistic imagination rather than lived reality.

-

-

Censorship vs. Freedom of Expression

-

MuchoHentai sits at the center of debates over whether adult media should be restricted or protected as a form of artistic expression.

-

The platform’s survival depends on balancing user freedom with compliance to global digital governance standards.

-

MuchoHentai and the Commercialization of Niche Content

Another critical dimension of MuchoHentai is its role in monetizing niche media. As adult platforms compete for audience attention, hentai has become a commercially viable segment.

-

Advertising and sponsorships – Targeted ads allow MuchoHentai to sustain operations while connecting with anime-related markets.

-

Premium content models – Some platforms experiment with subscription services or partnerships with creators.

-

Global reach – The demand for hentai is no longer limited to Japan, with Western markets increasingly contributing to growth.

This commercialization underscores the broader shift in digital adult industries, where once-fringe subcultures now drive mainstream revenue.

Cultural Criticism and Controversy

MuchoHentai’s rise has also fueled criticism and cultural debate.

-

Normalization of extreme fantasies – Some argue that easy access risks desensitization or unhealthy consumption patterns.

-

Cultural appropriation – The global popularity of hentai often divorces the genre from its Japanese roots, raising questions of cultural respect.

-

Moral panic – Adult anime is often singled out in discussions about internet “corruption,” despite its parallels with Western adult media.

While these criticisms persist, proponents emphasize the importance of context, intent, and personal responsibility in interpreting hentai as media.

MuchoHentai in the Broader Context of Internet Culture

MuchoHentai represents a microcosm of how internet culture handles desire, fantasy, and taboo. Its success reflects broader shifts in how audiences:

-

Consume content – Streaming and digital access have replaced physical media.

-

Form communities – Online platforms provide validation and identity through shared fandom.

-

Negotiate taboos – The digital age encourages public discourse about once-hidden desires.

In this sense, MuchoHentai is not an outlier but a case study in digital fandoms, adult expression, and globalized culture.

Future of MuchoHentai and the Hentai Niche

As digital culture continues to evolve, MuchoHentai faces both opportunities and challenges:

-

Opportunities

-

Integration with VR and immersive technologies.

-

Expansion into cross-media storytelling, blending hentai with gaming or interactive art.

-

Stronger connections with content creators for ethical and sustainable distribution.

-

-

Challenges

-

Stricter international regulations on adult content.

-

Increasing competition from decentralized, creator-driven platforms.

-

Navigating ethical debates without alienating core audiences.

-

The platform’s adaptability will determine whether it remains a cornerstone of hentai culture or is overtaken by emerging trends.

Conclusion

MuchoHentai exemplifies the intersection of digital culture, adult entertainment, and online fandom. As a platform, it reflects not only the enduring popularity of hentai but also the broader cultural conversations about fantasy, freedom, and responsibility in the digital age.

BLOG

Cameron Yaste: Charting the Rise of a Visionary Talent

In today’s dynamic world, where creativity, leadership, and innovation define success, the story of Cameron Yaste shines as a remarkable example of a visionary talent on the rise. Known for his ability to merge artistry, strategy, and forward-thinking perspectives, Yaste represents a new generation of professionals redefining what it means to make an impact. Whether in the fields of entrepreneurship, creative direction, or thought leadership, Cameron Yaste has steadily built a reputation as a multi-dimensional talent who blends passion with purpose.

This article takes a closer look at Cameron Yaste’s journey, exploring his background, contributions, philosophy, and future trajectory. It also highlights why his approach resonates so strongly in the current cultural and professional climate.

Early Inspirations and Background

The rise of any visionary talent often begins with a spark of curiosity and ambition. For Cameron Yaste, this spark came from an early exposure to creative problem-solving and innovative thinking. With a natural interest in how ideas can shape industries and transform lives, Yaste developed an early sense of direction that would later define his career.

While many talents remain confined to one field, Yaste’s growth was shaped by interdisciplinary learning. His experiences across diverse domains—ranging from digital culture to business strategy—allowed him to cultivate a holistic worldview. This wide-ranging foundation would later become central to his ability to think outside the box and challenge traditional boundaries.

The Rise of a Visionary

What distinguishes Cameron Yaste from many rising talents is not just skill, but vision. Instead of merely reacting to industry trends, Yaste anticipates them, positioning himself at the intersection of innovation and culture.

His early projects revealed a unique ability to merge creativity with functionality. Unlike traditional professionals who rely solely on expertise in one niche, Yaste combined insights from multiple disciplines to craft fresh, impactful solutions. This interdisciplinary edge has been key to his rapid rise.

Core Strengths and Skillset

1. Innovative Thinking

Cameron Yaste excels at turning challenges into opportunities, often approaching problems from unexpected angles. His forward-looking mindset enables him to not only adapt but lead change.

2. Creative Versatility

A hallmark of Yaste’s talent is his adaptability across fields. From conceptualizing strategies to executing creative visions, he thrives in dynamic environments where flexibility is essential.

3. Leadership by Inspiration

Instead of relying on rigid management, Yaste inspires through collaboration and empowerment. His leadership style emphasizes mentorship, inclusivity, and long-term growth.

4. Digital Fluency

In an era shaped by digital transformation, Yaste has embraced technology not as a tool but as an extension of creativity and strategy. His grasp of digital ecosystems has elevated his ability to influence audiences and drive change.

Professional Milestones

Every visionary leaves behind milestones that mark their trajectory. For Cameron Yaste, these achievements span across personal creativity, professional leadership, and cultural contribution:

-

Early recognition in creative communities for his fresh perspectives.

-

Development of strategic projects that bridged business innovation with cultural storytelling.

-

Collaboration with teams and organizations to drive meaningful results.

-

Ongoing pursuit of projects with social impact, reflecting his commitment to purposeful innovation.

These milestones not only highlight his growth but also underscore his commitment to excellence and evolution.

The Philosophy Behind His Success

At the heart of Cameron Yaste’s rise is a guiding philosophy that blends innovation, authenticity, and resilience. His approach rests on a few core principles:

-

Authenticity Builds Trust – By staying true to his vision and values, Yaste fosters genuine connections.

-

Innovation Requires Courage – He embraces risks as part of the creative process, understanding that breakthrough ideas often come from bold experimentation.

-

Collaboration is Power – Yaste values teamwork and believes collective creativity produces greater outcomes.

-

Adaptation is Key – In fast-changing industries, adaptability is the difference between staying relevant and becoming obsolete.

This philosophy has helped him navigate challenges and stay ahead of industry shifts.

Cultural Relevance of Cameron Yaste

Why does Cameron Yaste’s story resonate so deeply today? The answer lies in the current cultural climate, where audiences and industries are drawn to authenticity, innovation, and purpose-driven leadership.

In a world of rapid technological change, Yaste represents adaptability. In a society hungry for authentic voices, he represents genuine connection. And in industries demanding innovation, he embodies visionary creativity.

This cultural alignment amplifies his influence, making his rise not just personal but also symbolic of a larger generational shift.

Impact on Digital and Creative Industries

Cameron Yaste’s impact can be felt across creative, entrepreneurial, and digital landscapes.

-

In the digital world, his approach showcases how individuals can use technology for meaningful expression and transformation.

-

In the creative industry, he highlights the importance of versatility and pushing boundaries.

-

In the entrepreneurial space, he demonstrates that success comes from aligning vision with execution, not just chasing trends.

His work contributes to the ongoing redefinition of industries that are rapidly evolving in the 21st century.

Lessons from Cameron Yaste’s Journey

Aspiring professionals and creatives can draw several lessons from Cameron Yaste’s path:

-

Pursue breadth and depth – Building expertise across multiple domains can provide a competitive edge.

-

Stay authentic – Genuine expression and values resonate stronger than superficial success.

-

Embrace technology – Digital fluency is a necessity, not an option.

-

Think long-term – Sustainable growth comes from vision, not just short-term gains.

These lessons highlight how Yaste’s approach can serve as a roadmap for future visionaries.

The Future Ahead

The trajectory of Cameron Yaste suggests a future filled with expanded influence and deeper impact. With industries increasingly prioritizing sustainability, digital transformation, and cultural authenticity, Yaste is poised to become not just a contributor but a leader shaping the direction of innovation.

Potential future endeavors include:

-

Global collaborations bridging industries and cultures.

-

Mentorship initiatives to inspire the next generation.

-

Technological innovation integrating creativity with AI and emerging tools.

-

Social impact projects aimed at fostering equity and sustainability.

The next chapter of Cameron Yaste’s career promises to be as transformative and inspiring as his journey thus far.

Conclusion

The rise of Cameron Yaste is a powerful story of vision, talent, and purpose. By blending innovation with authenticity, creativity with strategy, and leadership with collaboration, Yaste exemplifies what it means to be a visionary talent for the modern age.

BLOG

Eitzinger Gitti: Unveiling the Fascinating World of a Unique Cultural Artifact

In the realm of cultural artifacts, few items are as intriguing and multifaceted as the Eitzinger Gitti. This unique object holds a significant place within its cultural context, showcasing the interplay between tradition, craftsmanship, and modern interpretations. In this article, we will explore the history, significance, and the artistic value of the Eitzinger Gitti, unveiling the stories and meanings it embodies.

Historical Context of Eitzinger Gitti

To fully appreciate the Eitzinger Gitti, one must delve into its historical background. This cultural artifact can trace its origin to a specific region and time period characterized by rich traditions and vibrant communities. The roots of the Eitzinger Gitti can be found in crafts developed centuries ago, often tied to the local economy, religious practices, or social structures of the communities that created it.

Understanding the Eitzinger Gitti requires examining the historical events that shaped its development. This can include periods of migration, trade, and cultural exchange, all of which contributed to the evolution of artistic techniques and materials. It serves as a historical marker, providing insight into the broader narrative of human expression and community life.

The Craftsmanship Behind Eitzinger Gitti

One of the most striking aspects of the Eitzinger Gitti is the exceptional craftsmanship that goes into its creation. Artisans spend years honing their skills, often passing down techniques through generations. This tradition of craftsmanship ensures that each Gitti is not merely an object but a labor of love, embodying the values and aesthetics of its creators.

The materials used in crafting the Eitzinger Gitti’s can vary based on local resources and artistic preferences. Commonly, natural elements such as wood, stone, or clay might be utilized, each adding unique characteristics to the final product. The intricate designs and patterns found on the Gitti are not only visually appealing but also laden with meaning, often representing cultural narratives, beliefs, or historical events.

Cultural Significance of Eitzinger Gitti

Beyond its aesthetic appeal, the Eitzinger Gitti holds significant cultural value. It often serves as a symbol of identity for the community, a representation of shared experiences and collective memory. The stories tied to the Eitzinger Gitti’s can illustrate social norms, historical events, or spiritual beliefs that resonate with the people who cherish it.

The importance of the Eitzinger Gitti’s is also reflected in rituals and ceremonies where it might play a role. From community gatherings to religious practices, the presence of the Eitzinger GittGitti’s i can enhance the significance of these events, serving as a focal point for connection between individuals and their cultural heritage.

Modern Interpretations and Adaptations

In recent times, the Eitzinger Gitti has also evolved, adapting to contemporary contexts while retaining its essence. Artists and designers are reimagining traditional designs, integrating modern aesthetics and techniques that resonate with younger generations. This fusion of old and new allows for creative expressions that honor the original craftsmanship while appealing to current tastes.

Furthermore, the globalization of art and culture means that the Eitzinger Gitti’s is no longer confined to its region of origin. It has found a place in international markets, art collections, and exhibitions, sparking interest and appreciation among global audiences. This exposure can lead to a revitalization of interest in traditional arts, prompting discussions around cultural preservation and innovation.

Conclusion: The Legacy of Eitzinger Gitti

The Eitzinger Gitti stands as a testament to the enduring nature of cultural artifacts. It encapsulates the history, craftsmanship, and significance of the communities that create and cherish it. As we continue to explore and appreciate the nuances of the Eitzinger, we are reminded of the rich tapestry of human expression and the importance of preserving our cultural legacies.

-

BUSINESS2 months ago

BUSINESS2 months agoPrince Narula Digital PayPal Success: Transforming Online Payments

-

ENTERTAINMENT2 months ago

ENTERTAINMENT2 months agoHighlights and Analysis: WWE SmackDown Episode 1491 Recap

-

ENTERTAINMENT1 year ago

ENTERTAINMENT1 year agoWWE SmackDown Episode 1488 Delivers a Knockout Performance

-

videos11 months ago

videos11 months agobad hair day episode 1 a sore subject

-

LAW11 months ago

LAW11 months agoAn Intriguing Journey into the Life of Jeff Tietjens

-

HOME1 year ago

HOME1 year agoMaximizing Basement Space: Design Tips from Top Basement Renovation Contractors

-

CELEBRITY2 years ago

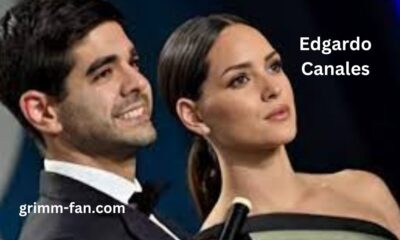

CELEBRITY2 years agoDiscovering Edgardo Canales The Life and Journey of Adria Arjona’s Husband

-

News2 years ago

News2 years agoNews JotechGeeks Takes the Spotlight in Tech News World